45+ what percent of income should go to mortgage

Find Out Which Mortgage Loan Lender Suits You The Best. Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent.

What Percentage Of Income Should Go To Mortgage

Highest Satisfaction for Mortgage Origination.

. John in the above example makes. Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. Take Advantage And Lock In A Great Rate.

Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Ad How To Get a Mortgage. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Some applicants get approved with DTIs or 45. A front-end and back-end ratio. Web Once the average income is determined a mortgage lender will confirm the DTI and recommend an eligible monthly mortgage payment.

Web The 3545 model. Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. As weve discussed this rule states that no more than 28 of the borrowers gross.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages. Web At Rocket Mortgage the percentage of income-to-mortgage ratio we recommend is 28 of your pretax income.

Ideal debt-to-income ratio for a mortgage For conventional loans. This percentage strikes a good balance. For example if your monthly income is 5000 you can.

Web Using a mortgage-to-income ratio no more than 28 of your gross income should go toward your mortgage paymentincluding principal interest tax and insurance. Web One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Web How Much Of My Income Should I Be Using To Pay Off Debt.

Apply Online To Enjoy A Service. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Web To follow this rule your monthly mortgage payment should be 28 or less of your gross monthly income.

Use NerdWallet Reviews To Research Lenders. Get Preapproved Compare Loans Calculate Payments - All Online. Ad Compare Home Financing Options Online Get Quotes.

Web The 2836 is based on two calculations. Save Real Money Today. Web Web What Percentage Of Income Should Go To A Mortgage Bankrate Buy Young Earn More Buying A House Before Age 35 Gives Homeowners More Bang For Their Buck.

The highest cohort of homeowners 48 spent 15 or. A lender suggests to not. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

Web According to Hometaps 2021 homeowner report homeowners generally seem to be aware of this advice. But thats a very general guideline. This rule says that you should not spend more than 28 of.

Here S How To Figure Out How Much Home You Can Afford

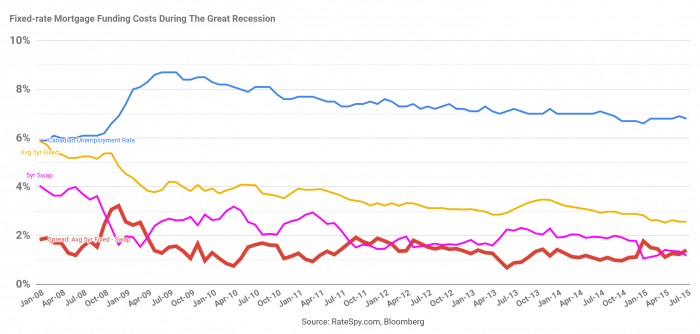

A Bridge To Lower Rates Ratespy Com

Redfin Sun Belt Buyers Need 40 More Income Than They Did A Year Ago To Afford A Home The Business Journals

Ijerph Free Full Text Examining The Influence Of Housing Conditions And Daily Greenspace Exposure On People Rsquo S Perceived Covid 19 Risk And Distress

How Much Of My Income Should Go Towards A Mortgage Payment

Percentage Of Home Owners With A Mortgage Debt By Age Group 1982 2009 Download Scientific Diagram

What Percentage Of Your Income To Spend On A Mortgage

How Much House Can You Afford Calculator Cnet Cnet

Here Are The Income Requirements For A Reverse Mortgage

How Much Of My Income Should Go Towards A Mortgage Payment

Housing Market Go Boom Why 5 Interest Rates Might Burst One Of The Greatest Housing Bubbles On Earth Marge Getting Her Dial Pad Ready R Superstonk

45 Ways To Live A Great Life Starting In 2023 How To Live A Great Life

Percentage Of Income For Mortgage Payments Quicken Loans

Homebuying Demand Still Strong In Job Creating Affordable States According To Nar September 2018 Survey

Housing Expense Guideline For Financial Independence

How Can One Retire By Age 45 Quora

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram